operating cash flow ratio ideal

Once cash flow is determined the. A ratio of 11 is considered ideal.

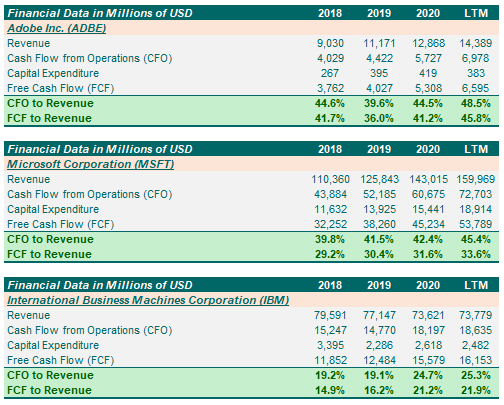

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

The price-to-cash flow PCF ratio is a multiple that compares a companys market value to its operating cash flow or its stock price per share to operating cash flow per.

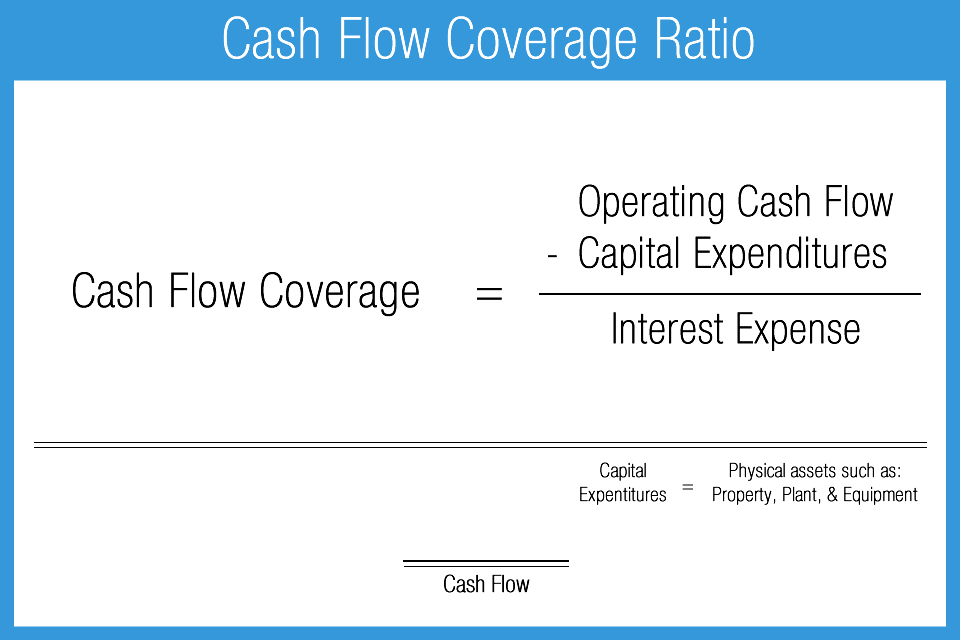

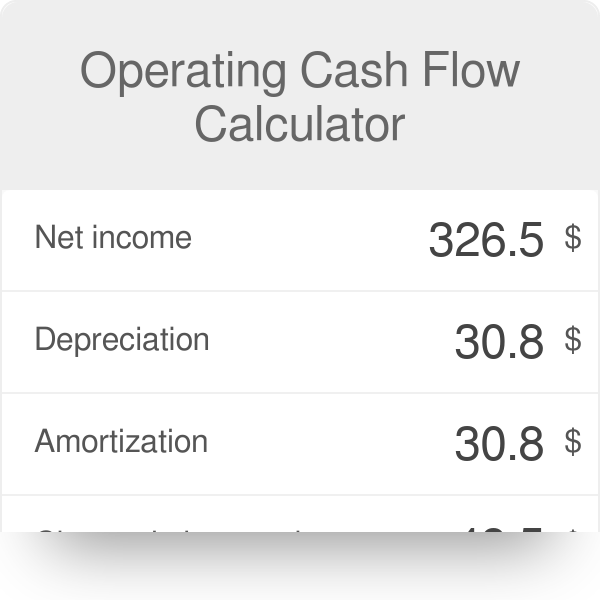

. The Formula for the Cash Flow-to-Debt Ratio Cash Flow to Debt Cash Flow from Operations Total Debt beginaligned textCash Flow to Debt frac textCash Flow. A company may be able to. We calculate the cash flow from operating activities for 2019 as.

Cash Flow to Debt Ratio Cash Flow from Operations Total Outstanding Debt. This is because it shows a better ability to cover current liabilities using the money. The components of OCF ratio are the cost of goods sold.

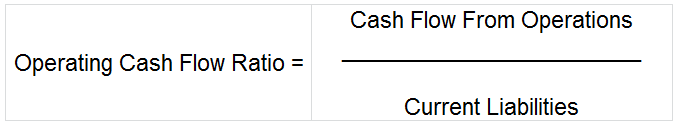

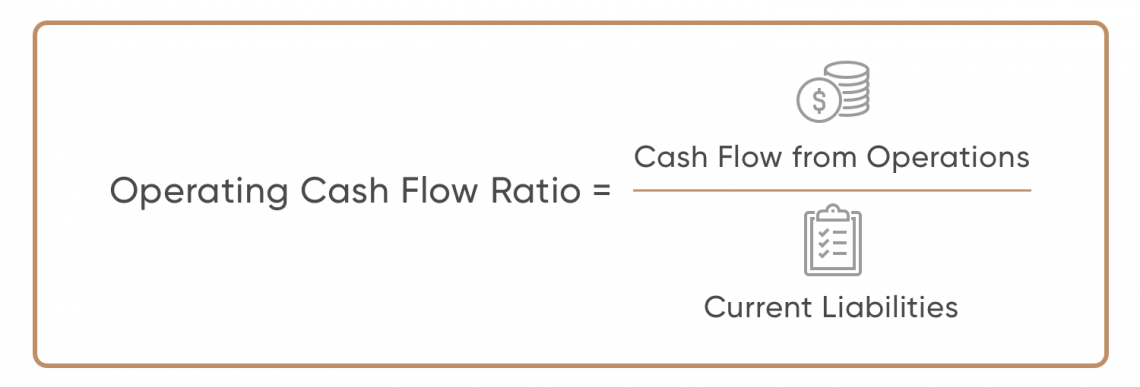

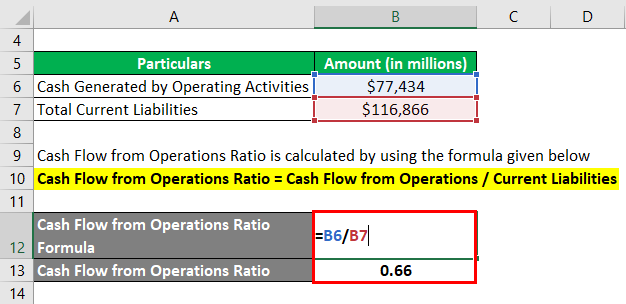

OCF Ratio Cash flow from core operations Current liabilities. Since earnings are more easily manipulated using cash flow is preferred as a more effective measurement. Operating Cash Flow Ratio Operating Cash Flow Current Liabilities.

Use the formula below to calculate your companys operating cash flow ratio. The operating cash flow ratio is not the same as the operating cash flow margin or the net income. Operating cash flow ratio.

The operating cash flow ratio OCF ratio formula can be written as. Conclusions must not be drawn based on a single number. Operating Cash Flow to Sales Ratio Operating Cash Flow Sales.

For instance banks have low operating expense ratios sometimes as little as 0. This ratio calculates how much cash a business makes from its sales. Similarly current account savings account CASA ratio of bank.

A higher ratio is more desirable. The operating cash flow ratio formula looks as follows. The Balance Sheet A balance sheet is one of the financial.

A preferred operating cash flow number is greater than one because it. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. Net Income 2100000.

How can we calculate the Operating Cash to Debt Ratio. So a ratio of 1. In general terms an operating cash flow to sales ratio of 10 to 55 is considered good with a higher number indicating a better ability to convert sales directly into cash.

Cash Flow From Operating Activities 2100000. Total debt calculated from the balance sheet. In this case we want Cash Flow from Operations or Free Cash Flow which is equal to operating cash flow minus capital expenditures.

Operating Cash Flow. Operating cash flow Net cash from operations Current liabilities. At the top of the cash flow statement we can see that Apple carried over 50224 billion in cash from the balance sheet and 22236 billion in net income or.

Working Capital 1300000. There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations. Used Over a Period of Time.

Operating cash flow ratio CFO Current liabilities.

Cash Flow Ratios Calculator Double Entry Bookkeeping

What Is Operating Cash Flow Ratio Accounting Capital

Cash Flow Ratios Accounting Play

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow Ratios How Do They Work Novuna

Operating Cash Flow Ratio Formula Gocardless

Financial Ratios Calculations Accountingcoach

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Operating Cash Flow Ratio Calculator

Operating Cash Flow Ratio Definition And Meaning Capital Com

What Is A Good Operating Cash Flow Ratio

8 Cash Flow Ratios Every Investor Must Know

The 10 Cash Flow Ratios Every Investor Should Know

Cash Conversion Ratio Financial Edge

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Pdf Liquidity Analysis Using Cash Flow Ratios And Traditional Ratios The Telecommunications Sector In Australia Semantic Scholar

/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)